You may have observed pay day loan, although you’ve never received you to. And you may healthy for you for many who haven’t heard of pay day loan as they are a very bad tip.

Let us put it that way: these are generally some of those financial plans which is very an easy task to rating towards the, but painfully difficult to find regarding.

In this post, I’m unpacking just what payday loan try, and exactly why you need to look for options to this particular loan.

What’s an online payday loan?

An online payday loan is a highly quick-name loan. Which is short-identity, as with only about a couple weeks. They’re usually available using pay check loan providers situated in storefronts, however are in fact also operating on the web.

Payday loans work most effectively for many who you prefer cash in an excellent hurry. That is because the whole application processes might be finished in a beneficial matter of minutes. Literally!

Payday loan providers tend to be certain that your income and you can a bank checking account. It make sure the cash to determine your ability to settle. Nevertheless the family savings enjoys a very certain mission.

Just how can cash advance work?

If for example the financing is approved, money are deposited with the affirmed savings account. But moreover, the financial institution will require you establish an effective postdated sign in payment out-of both the amount borrowed in addition to notice charged to the they.

Instance, let’s say that you’re granted an effective $five hundred mortgage to the Oct 16. Because mortgage will need fees within fourteen days, you’ll make a back once again to the lending company that is dated to own October 29. The fresh new glance at might possibly be having $575 $five-hundred due to their loan fees, including $75 to possess interest.

The fresh new postdated view means the lending company was paid down from the booked day and they won’t have to chase you to get it. Individuals tolerate the fresh postdated see arrangement because almost every other big part you to definitely lenders usually take a look at credit history is actually neglected from the pay check lenders.

The financial institution will wanted that your salary is instantly placed to the affirmed financial. The new postdated examine will then be set to coincide on payroll put, ensuring that the fresh post-dated look at tend to clear the brand new membership.

The causes anybody bring payday loan

Individuals with less than perfect credit is sheer clients having payday loan. Brand new borrower can put on into financing, rather than end up being whatsoever worried one to their borrowing from the bank try both unappealing or nonexistent.

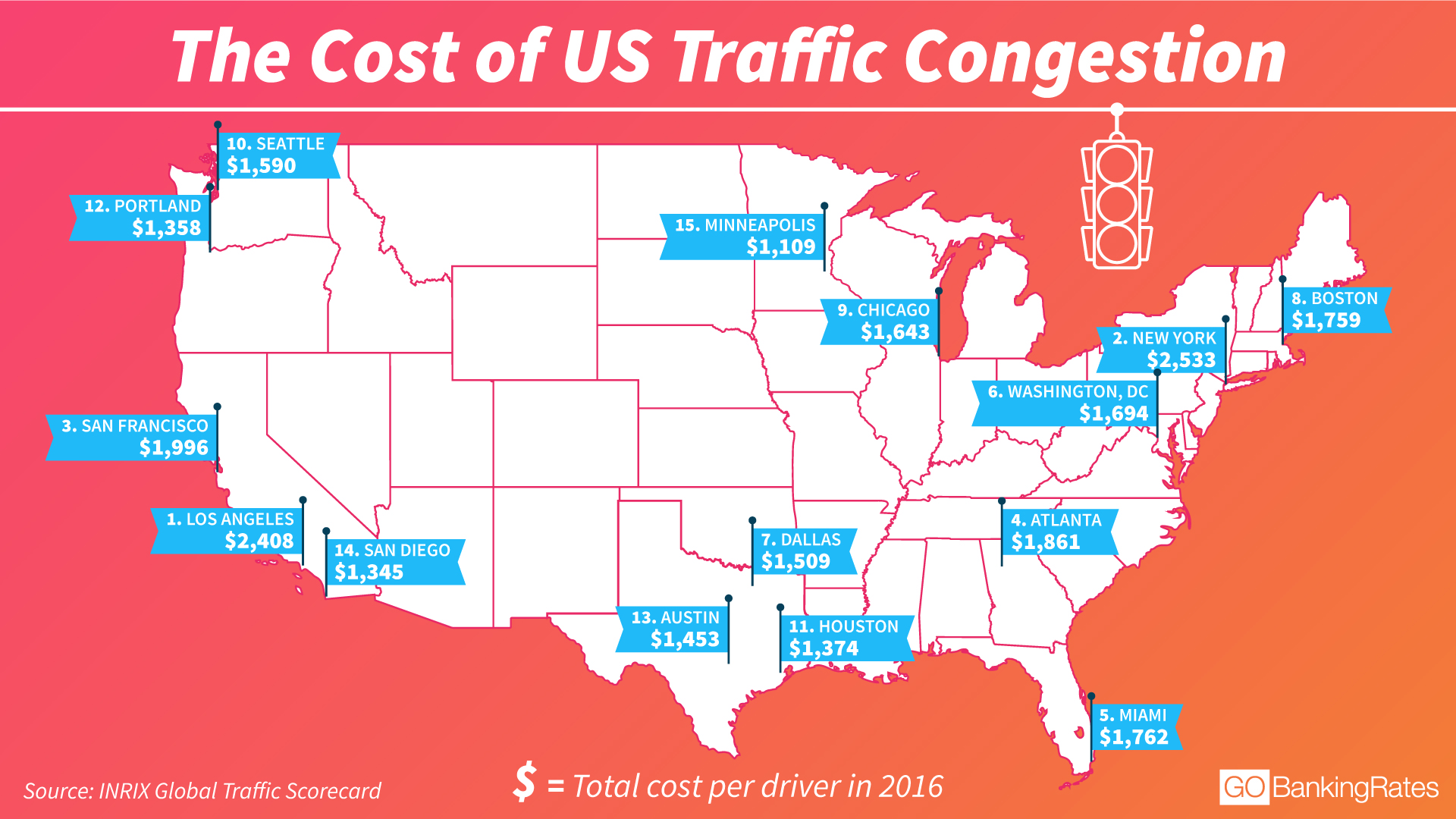

Individuals with hardly any savings show other pure erica live toward a paycheck-to-income basis. An effective 2019 questionnaire from the Wade Financial Cost unearthed that 69% out-of American properties have less than simply $step one,100000 in the savings. One to reveals the massive prospective marketplace for payday loans, and why they might be therefore stubbornly prominent.

Such as for example, for those who have less than perfect credit, no deals, and you will vehicles problems and you also read that it’ll grab $700 to solve it. You desire the automobile to arrive at works, and because you have no available credit no savings, you seek out pay day loan providers. You have no idea how to make $700 (plus attract) in 2 months, but the mortgage purchases your a little while and you have no clue that there are indeed great alternatives to a payday loan.

Payday loan are utilized rather than disaster discounts membership, even though the believe provides learned that of many additionally use them to possess regular cost of living.

The newest bad part on payday loan

The most obvious issue with payday loans ‘s the cost. We just performed a good example of a debtor which will pay $75 inside the interest to own an effective $five-hundred financing. If that is the expense of focus getting a full year, the interest rate could well be fifteen%. That will be a decent rates online payday loan Connecticut for someone that sometimes less than perfect credit or no credit, which can be providing an unsecured loan.