Understanding Exness Commodities: Trading Strategies and Insights

Trading in the financial markets has become increasingly popular in recent years, with many platforms offering a variety of assets for traders. One such platform is exness commodities تطبيق Exness, which provides access to a wide range of commodities. In this article, we will delve into what Exness commodities are, their significance in the trading landscape, and effective strategies to navigate this market successfully.

What Are Commodities?

Commodities are basic goods that are interchangeable with other goods of the same type. They are typically divided into two categories: hard commodities and soft commodities. Hard commodities are natural resources that are mined or extracted, such as gold, oil, and metals. Soft commodities refer to agricultural products or livestock, including coffee, corn, and cattle. Trading commodities allows investors to diversify their portfolios, hedge against inflation, and take advantage of market fluctuations.

The Role of Exness in Commodity Trading

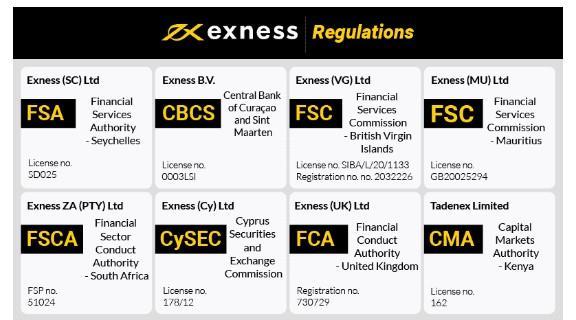

Exness has made a name for itself in the online trading arena by offering an easy-to-use platform that caters to traders at all levels. One of the standout features of Exness is its vast selection of trading instruments, including a comprehensive list of commodities. The platform provides competitive spreads and leverage, making it an attractive option for those looking to invest in this asset class.

Types of Commodities Available on Exness

Exness offers a variety of commodities for trading, allowing investors to select from different markets based on their preferences and strategies. Here’s a look at some of the key categories of commodities available:

- Metals: Precious metals like gold and silver are popular among investors as they often retain value during economic downturns.

- Energy: Crude oil and natural gas are crucial for global economies, and their prices can be volatile, presenting both risks and opportunities.

- Agricultural Products: Items such as wheat, corn, and soybeans are influenced by seasonal factors and global demand.

Why Trade Commodities?

There are several reasons why traders might choose to focus on commodities:

- Diversification: Adding commodities to your portfolio can help reduce overall risk by lowering correlation with other asset classes.

- Inflation Hedge: Commodities often maintain their value during inflationary periods, making them a hedge against economic downturns.

- Market Volatility: The commodities market can experience significant price swings, presenting opportunities for profit.

Strategies for Trading Exness Commodities

Successful trading in commodities requires a sound strategy and an understanding of market forces. Here are some key strategies that traders often employ:

1. Fundamental Analysis

Understanding the factors that influence commodity prices is critical. This includes geopolitical events, economic reports, and changes in supply and demand. For instance, a supply shock due to natural disasters can lead to an increase in prices for agricultural commodities.

2. Technical Analysis

Using charts and indicators to identify potential entry and exit points can be beneficial. Traders often look for patterns, support and resistance levels, and chart indicators that can signal trends.

3. Diversification Within Commodities

Investing in a variety of commodities rather than focusing on just one type can mitigate risk. This means balancing investments between hard and soft commodities to take advantage of different market conditions.

4. Risk Management

Implementing strict risk management strategies is essential. Setting stop-loss orders and determining position sizes based on account balance can help protect your capital from significant losses.

Market Trends Affecting Exness Commodities

Staying ahead of market trends is necessary for any commodities trader. Factors such as currency fluctuations, changes in consumer preferences, and advancements in technology can all significantly impact commodity prices.

The Future of Commodities Trading with Exness

As the global economy evolves, so does the landscape of commodities trading. With the integration of technology in trading platforms like Exness, traders will have greater access to data and analytics. Furthermore, trends like sustainability and renewable energy could shape the future of commodities, providing new avenues for investment.

Conclusion

Exness commodities offer a lucrative avenue for traders looking to diversify their portfolios and capitalize on market trends. By employing strategic trading methods, understanding market dynamics, and utilizing the resources provided by Exness, traders can navigate this exciting market successfully. Whether you are a novice or an experienced trader, the world of commodities trading holds numerous opportunities waiting to be uncovered.