Content

Simple interest loans are those loans in which interest is paid on the unpaid loan balance. Thus, the borrower is required to pay interest only on the actual amount of money outstanding and only for the actual time the money is used (e.g. 30 days, 90 days, 4 months and 2 days, 12 years and one month). Unsecured loans are credit given out by lenders on no other basis than a promise by the borrower to repay. The borrower does not have to put up collateral and the lender relies on credit reputation. Unsecured loans usually carry a higher interest rate than secured loans and may be difficult or impossible to arrange for businesses with a poor credit record.

The goal of the cash flow statement is to show the amount of generated and spent cash over a specific period of time, and it helps businesses analyze the liquidity and long-term solvency. To get a grasp of the money coming into and going out of your business, you need a cash flow statement. If you’re having a hard time with financial statements, don’t worry—we’ll help you put your cash flow statement together. The cash changes in balance sheet and income statement affect the statement of cash flow. The residual represents the gross change in fixed assets for the period.

Cash From Investing Activities

The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets mean there will be investing items to display on the cash flow statement.

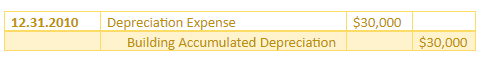

The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction. For that reason, smaller businesses typically prefer the indirect method. That means you know exactly how much operating cash flow you have in case you need to use it. However, you’ve already paid cash for the asset you’re depreciating; you record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life.

Overview: What Are Investing Activities?

We bought $30,000 worth of inventory, so our cash balance decreased by that amount. The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory. These financial statements systematically present the financial performance of the company throughout the year. The free cash flow can be calculated in a number of different ways depending on audience and what accounting information is available. A common definition is to take the earnings before interest and taxes, add any depreciation and amortization, then subtract any changes in working capital and capital expenditure. This sphere of cash flows also can be used to assess how much cash is available after meeting direct shareholder obligations and capital expenditures necessary to maintain existing capacity. Transactions that result in a decrease in assets will always result in an increase in cash flow.

CANNABICS PHARMACEUTICALS INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – marketscreener.com

CANNABICS PHARMACEUTICALS INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Mon, 29 Nov 2021 21:18:08 GMT [source]

Less difficulty exists when borrowers have considerable long-term borrowings at fixed rates. Normally, a rough idea of the average cost of borrowed capital for a firm is obtained by dividing the total interest paid by the company by the capital borrowed by the same company. Instalment loans are those loans in which the borrower or credit customer repays a set amount each period until the borrowed amount is cleared.

How Do You Calculate Cash Flow From Investing Activities?

The IASC considers the indirect method less clear to users of financial statements. Cash flow statements are most commonly prepared using the indirect method, which is not especially useful in projecting future cash flows. You use information from your income statement and your balance sheet to create your cash flow statement. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable, inventory, and accounts payable.

Therefore, analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements. Usually, changes in cash from investing are a “cash-out” item because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests an asset, the transaction is considered “cash-in” for calculating cash from investing.

Amount of cash outflow for payment of an obligation from a lender, including but not limited to, letter of credit, standby letter of credit and revolving credit arrangements. It is absolutely very normal activity because when u look at the balance sheet. The cash flow coming from each activity sometimes result positive and sometime give negative result. It is not necessary that the outcome of cash flow from any activity must be positive.

Cash Flow From Investing Activities

The operating activities section is, in a sense, a “catch-all” category. The free cash flow takes into account the consumption of capital goods and the increases required in working capital. When preparing the statement of cash flows, analysts must focus on changes in account balances on the balance sheet. GAAP and IFRS vary in their categorization of many cash flows, such as paying dividends. Some activities that are operating cash flows under one system are financing or investing in another. Investing activities involve transactions that use cash in the long term.

provided by used in operating activities.The cash flows from investing activities and financing activities would be presented the same way as under the direct method.

— Team 38 Insolvency Resolution Services (@team38irp) November 23, 2021

If this number is positive, then the company is generating more money than it’s spending for the normal operations of its business. If this number is negative, there may be something wrong with the company, which may lead the company to borrow more debt just to keep their normal business operations running. Obviously, if a company is taking on more debt to pay for its operations and maintain its cash positions, this is not sustainable over the long-term.

The Direct Method Of Calculating Cash Flow

In other words, this section measures the cash flow from a company’s provision of products or services. Some examples of operating activities include sales of goods and services, salary payments, rent payments, and income tax cash from investing activities payments. Cash flow from investing activities is one of the cash flow statement sections that tell you exactly how much cash has been spent or generated from different investment activities throughout a specific timeframe.

Amount of cash inflow from issuance of shares under share-based payment arrangement. Amount of cash outflow in the form of ordinary dividends to common shareholders of the parent entity.

Thus, if a company sustains an operating loss before depreciation, funds are not provided regardless of the magnitude of the depreciation charges. The statement therefore shows changes in cash and cash equivalents rather than working capital. Beginning cash and cash equivalents is the cash you have on hand at the beginning of a period. The cash inflow from the sale of long-lived, physical assets that are used in the normal conduct of business to produce goods and services and not intended for resale. In general, you should be aiming to invest in companies that have FCF growing at 10% or more over the 10-year period, and improving over time. This is because FCF is a strong indicator of how well a company’s stock price will grow over time. In short, this is because if a company is generating more FCF, then they’re essentially increasing the value of their business as well.

It is only when the company collects cash from customers that it has a cash flow. For example, cash generated from the sale of goods and cash paid for merchandise are operating activities because revenues and expenses are included in net income. Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company.

Operating capital in a company or firm usually refers to production inputs that are normally used up within a production year. On the other hand, investment capital refers to durable resources like machines and buildings in which money invested is tied up for several years.

- FINPACK and other programs can create more detailed cash flows.The statement of cash flows examines how cash has entered and left your financial life during the year.

- The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors.

- If you see a company taking on large amounts of debt, while at the same time paying down a lot of debt, this can indicate that a company is paying off long-term debt with more debt.

- However, negative cash flow should not automatically raise a red flag without further analysis.

- Thus, the net income of a company usually understates the value of funds provided by operations by the value of the depreciation – in this case by $100,500.

- Marketable SecuritiesMarketable securities are liquid assets that can be converted into cash quickly and are classified as current assets on a company’s balance sheet.

Cash flow from investing activities is a line item on a business’s cash flow statement, which is one of the major financial statements that companies prepare. Cash flow from investing activities is the net change in a company’s investment gains or losses during the reporting period, as well as the change resulting from any purchase or sale of fixed assets. One objective of financial reporting is to provide information that is helpful in assessing the amounts, timing, and uncertainty of an organization’s cash inflows and outflows. As a result, the statement of cash flows provides three broad categories that reveal information about operating activities, investing activities, and financing activities. In addition, businesses are required to reveal significant noncash investing/financing transactions. Investing activities are one of the main categories of net cash activities that businesses report on the cash flow statement.

Cash outflows consist of payments for inventory, trading securities, employee salaries and wages, taxes, interest, and other normal business expenses. To generalize, cash from operating activities is generally linked to those transactions and events that enter into the determination of income. However, another way to view “operating” cash flows is to include anything that is not an “investing” or “financing” cash flow.

The third section of the cash flow statement is cash flow from investing. This is the cash flowing in and out of the business through activities that are treated as investments such as land, buildings, vehicles, machinery, and equipment. Cash flow statements are prepared using either the direct or the indirect method.

Amount of cash and cash equivalents, and cash and cash equivalents restricted to withdrawal or usage. Significant cash outflows are salaries paid to employees and purchases of supplies. Just as with sales, salaries, and the purchase of supplies may appear on the income statement before appearing on the cash flow statement. Operating cash flows, like financing and investing cash flows, are only accrued when cash actually changes hands, not when the deal is made. Whether you’re doing accounting for a small business or an international enterprise, cash flow from investing activities is important for a variety of reasons. Calculating cash flow from investing activities is completed automatically if you’re using accounting software to manage and record your financial activities.

- But it still needs to be reconciled, since it affects your working capital.

- Regardless, it’s fairly simple to identify a cash flow statement as it’ll always have operating, investing, and financing activities listed.

- Inc., and Lowe’s Companies, Inc., are large home improvement retail companies with stores throughout North America.

- This sphere of cash flows also can be used to assess how much cash is available after meeting direct shareholder obligations and capital expenditures necessary to maintain existing capacity.

- Asset AccountAsset Accounts are one of the categories in the General Ledger Accounts holding all the credit & debit details of a Company’s assets.

The amount of cash paid during the current period to foreign, federal, state, and local authorities as taxes on income. So we can say that the negative balance in very much positive in its effect. The operating activity is mostly made by the information gather from the current section of balance sheet. C) Repairs costs are principally variable costs incurred on assets because of the level of use of the assets through wear and tear. Some durable assets, however, deteriorate with time even though they are not used.

Purchase of Equipment is recorded as a new $5,000 asset on our income statement. It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand.

The company is thus paying interest on the face value of the note although it has use of only a part of the initial balance once principal payments begin. This type of loan is sometimes called the “flat rate” loan and usually results in an interest rate higher than the one specified. To calculate the cash flow from investing activities, you would have to add together the sum of how much you spend and gain on long-term acquisitions. Until you attain customers and achieve enough sales to at least break even, more cash will be going out of your business than is coming in. Hence, you may need to rely on personal funds, loans, credit cards, and lines of credit to carry you through this time. However, under projecting expenses or over projecting sales can leave you with a cash crisis. The cash outflow during the period from the repayment of aggregate short-term and long-term debt.

To analyze the cash flow statement, one should be able to understand, question, and look closer into appropriate line items on the cash flow statement. Cash flows from investing activities explains the cash flows generated or spent for any non-current (long-term) assets over a particular period. Any long-term physical and/or intangible asset that the company expects to deliver value in the future will be included in this section. Note that under an indirect cash flow statement, all cash outflows and inflows only represent adjustments to the net income number to get to the final cash flows from operating activities number. Greg didn’t invest any additional money in the business, take out a new loan, or make cash payments towards any existing debt during this accounting period, so there are no cash flows from financing activities.

Another interesting aspect to look into this CFI is the column of proceeds from the disposal of fixed assets, proceeds of the disposal of a business. If the figures are substantially high, it can help in the visualization of why the company is disposing of assets. Such Operating ExpenseOperating expense is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit. The main component is usually CapEx, but there can also be acquisitions of other businesses. This guide shows how to calculate CapEx by deriving the CapEx formula from the income statement and balance sheet for financial modeling and analysis.

Author: Kate Rooney