Forex trading in Malaysia has gained significant popularity over the years, as more individuals look to capitalize on the potential profits offered by the foreign exchange market. In this article, we will discuss the ins and outs of Forex trading in Malaysia, including the necessary steps to get started, the best trading platforms available, and essential strategies for successful trading. Moreover, it is important to consider reliable resources such as forex trading malaysia Forex Brokers in Côte d’Ivoire for traders looking to understand the global landscape of Forex trading.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies in pairs to profit from fluctuations in exchange rates. It is the largest financial market in the world, with a daily turnover exceeding $6 trillion. For many Malaysians, Forex trading presents an attractive opportunity to generate income, especially considering the country’s growing interest in alternative investment platforms.

The Forex Market in Malaysia

The Forex market in Malaysia operates under a regulated framework, overseen by the Securities Commission of Malaysia (SC) and Bank Negara Malaysia (BNM). These regulatory bodies ensure that brokers operate within the laws, providing traders with a safe trading environment. As a result, traders in Malaysia have access to numerous local and international brokers that cater to their trading needs.

Choosing a Forex Broker

Selecting the right Forex broker is crucial for any trader, no matter their experience level. Traders should consider several factors when choosing a broker, including:

- Regulation: Ensure that the broker is licensed and regulated by a recognized authority.

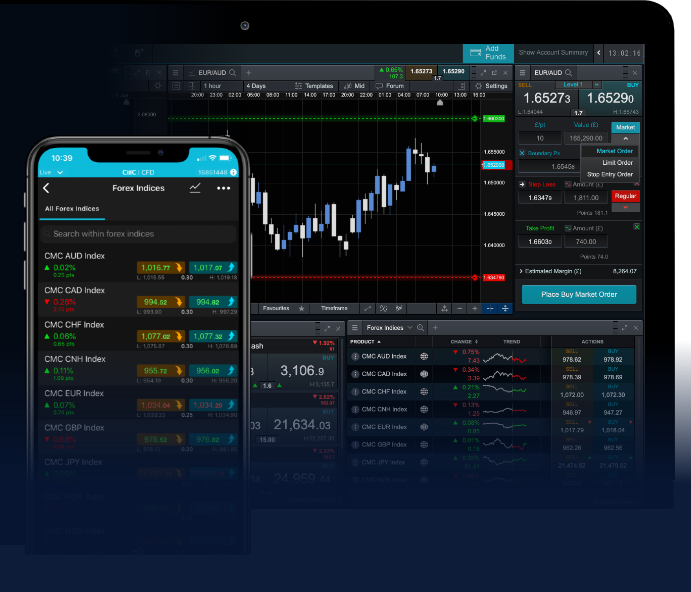

- Trading Platform: Look for user-friendly trading platforms that offer a range of tools and features.

- Spreads and Fees: Compare the spreads and commissions charged by different brokers.

- Customer Support: Consider the quality of customer support available, especially for new traders.

Getting Started with Forex Trading

For those interested in venturing into Forex trading, here are steps to initiate your journey:

1. Education and Research

Familiarize yourself with the basics of Forex trading. Numerous online resources, courses, and tutorials can help you grasp key concepts, strategies, and market analysis techniques. Knowing how to analyze charts and understand market trends is essential for making informed trading decisions.

2. Practice with a Demo Account

Before risking real money, consider opening a demo account with your chosen broker. A demo account allows you to practice trading with virtual funds in a risk-free environment, helping you gain confidence and refine your skills without financial pressure.

3. Develop a Trading Plan

A well-crafted trading plan is vital for successful trading. Outline your goals, risk tolerance, trading strategies, and criteria for entering and exiting trades. A solid trading plan can help you maintain discipline and reduce emotional decision-making.

4. Start Trading with Real Money

Once you feel comfortable with your knowledge and understanding, you can start trading with real money. Start with a small investment to mitigate risk while you further develop your strategy. Monitor your trades and be prepared to adapt to changing market conditions.

Trading Strategies for Success

Successful trading often relies on implementing effective strategies. Here are a few popular strategies used by traders in the Forex market:

1. Day Trading

Day trading involves making multiple trades within a single day, taking advantage of small price movements. This strategy requires a deep understanding of market dynamics and quick decision-making skills.

2. Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days or weeks to capture price swings. This approach is suitable for traders who cannot dedicate their time to monitoring the markets continuously.

3. Scalping

Scalping is a short-term trading strategy that involves making numerous trades throughout the day to profit from small price changes. Successful scalpers need a robust trading platform, full-time commitment, and an understanding of market microstructure.

Risk Management

Managing risk is paramount in Forex trading. Traders should implement risk management techniques to protect their capital and limit potential losses. This involves setting stop-loss orders, diversifying investments, and never risking more than a certain percentage of your capital on a single trade.

The Future of Forex Trading in Malaysia

As technology continues to evolve, the Forex trading landscape in Malaysia is likely to see significant changes. Increased access to trading platforms through mobile devices and advancements in artificial intelligence for market analysis are expected to shape the future of Forex trading. Additionally, the growing interest in cryptocurrency trading may also influence the Forex market, offering new opportunities and challenges to traders.

Conclusion

Forex trading in Malaysia presents a myriad of opportunities for investors looking to diversify their income streams. With the right knowledge, tools, and strategies, traders can navigate the complexities of the Forex market successfully. Always remember to conduct thorough research, select a reputable broker, and implement sensible risk management practices for a rewarding trading experience.